E-banking Made Easy for Banks Nationwide

Custom Mobile Banking Solution by WebVoltz

The Challenge

MDSL S.a.l. faced the challenge of delivering a flexible mobile banking solution that would enable banks in the Lebanon and Middle East region to create highly personalized banking experiences for their customers. Banks needed a platform that could be easily customized, allowing them to choose the features they wanted — from account management to payments — while aligning the solution with their unique brand identity.

Additionally, banks required a system that could scale to accommodate growing customer bases, while maintaining security, compliance, and the ability to integrate with Open Banking platforms. The solution needed to be adaptable for both cloud and on-premise setups, offering complete control over infrastructure and ensuring uninterrupted service.

The Solution

WebVoltz developed a custom mobile banking platform that allowed MDSL to meet the diverse needs of banks in the Lebanon and Middle East region. The solution provided a highly flexible architecture where banks could choose the features they needed from a set of modular micro-services. Each bank was able to create a tailored user experience by selecting only the functionalities that best suited their customers’ needs.

Key aspects of the solution included:

- Multi-Tenant Architecture: The platform enabled MDSL to support multiple banks on a single infrastructure, with each bank operating independently, ensuring data isolation while maintaining centralized control for ease of management.

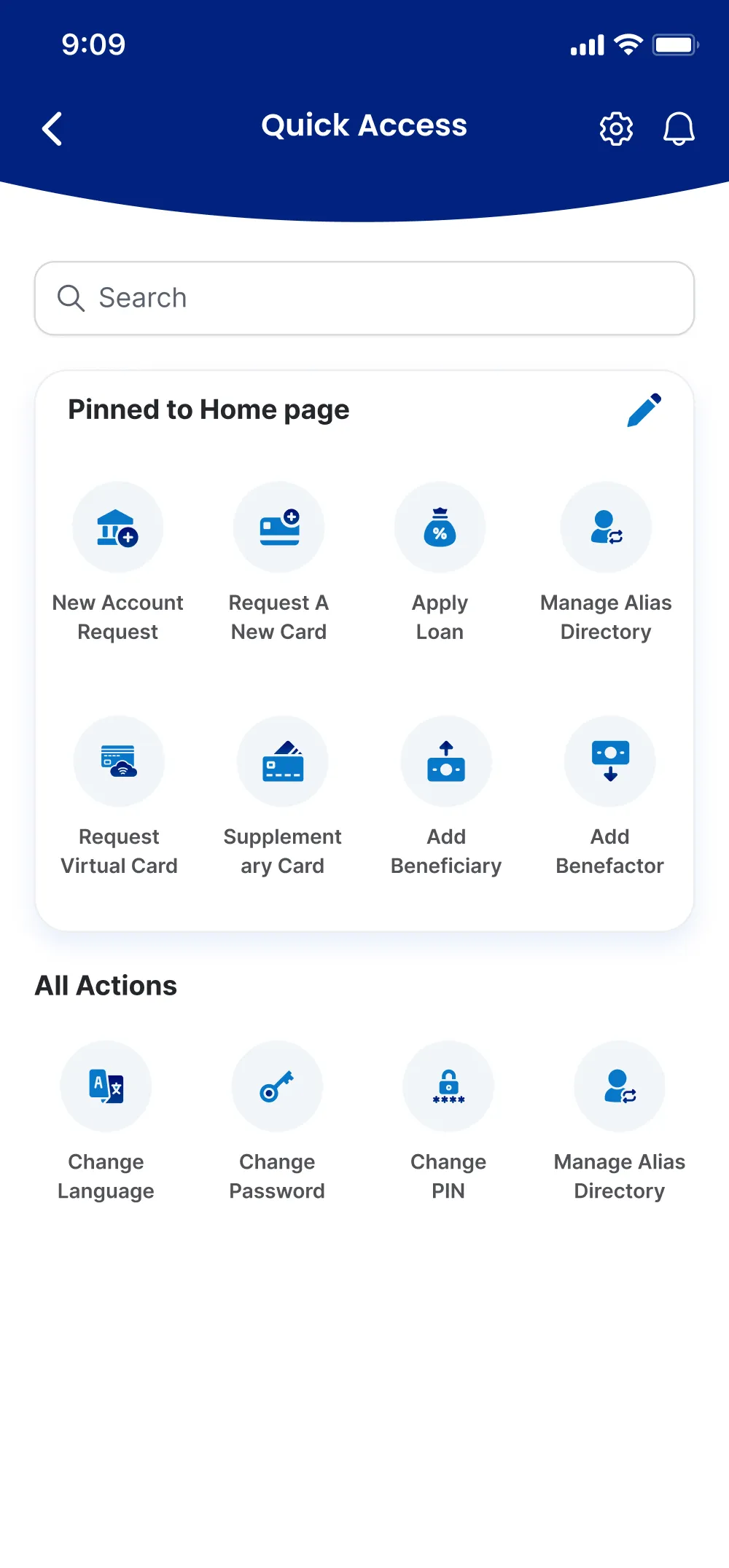

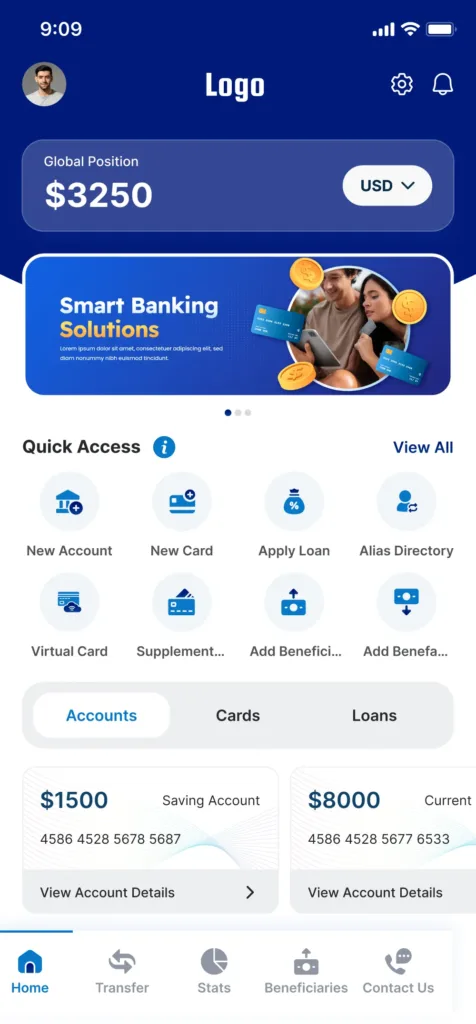

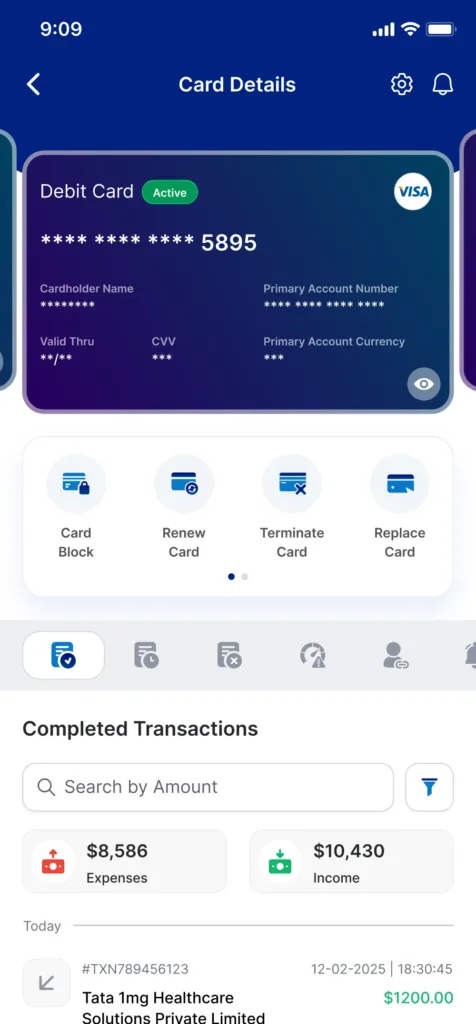

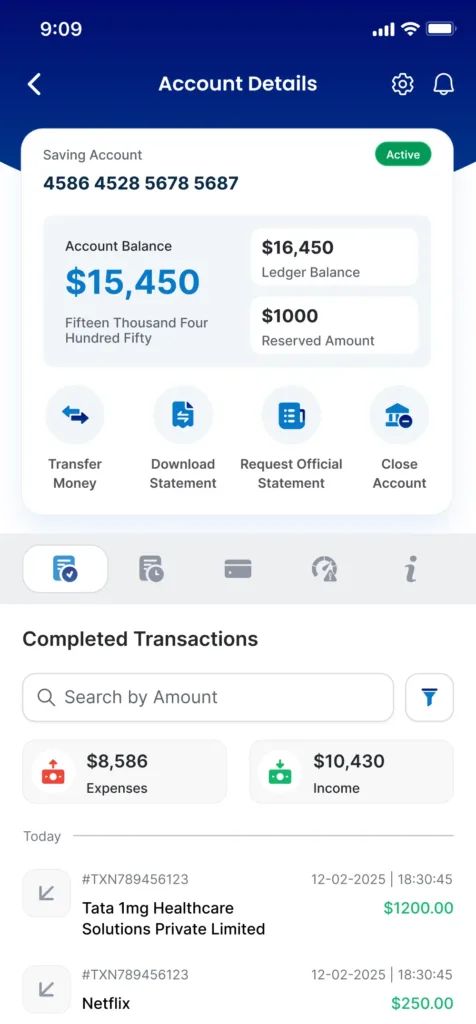

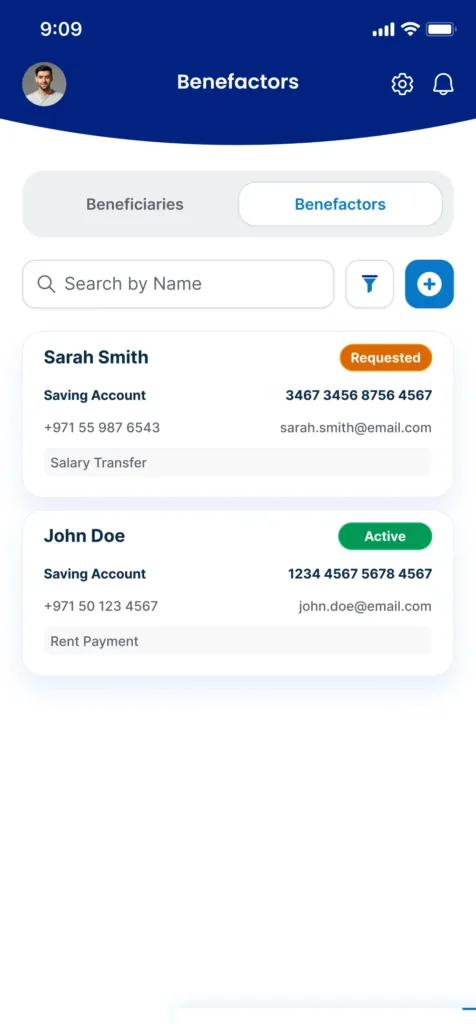

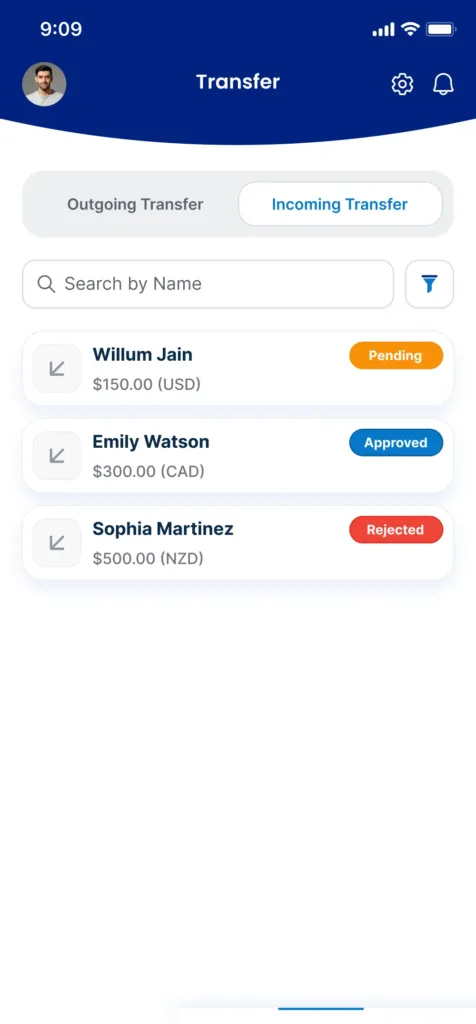

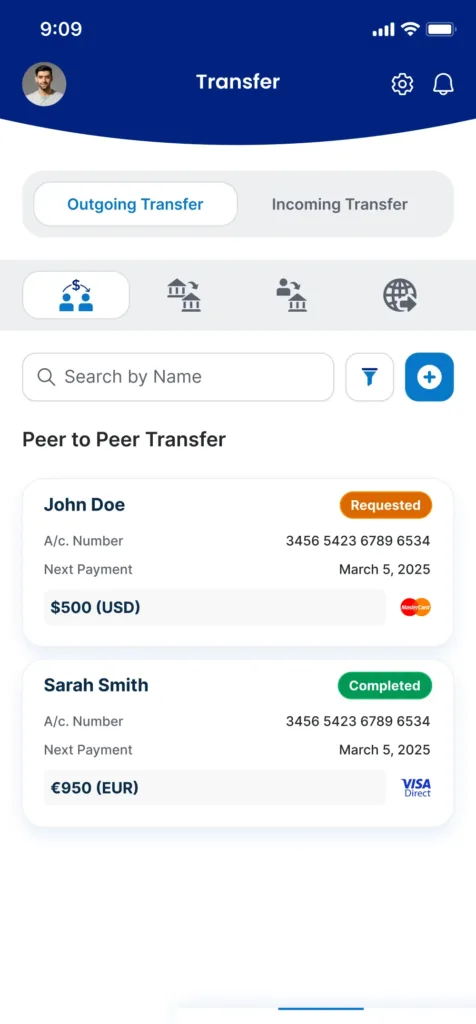

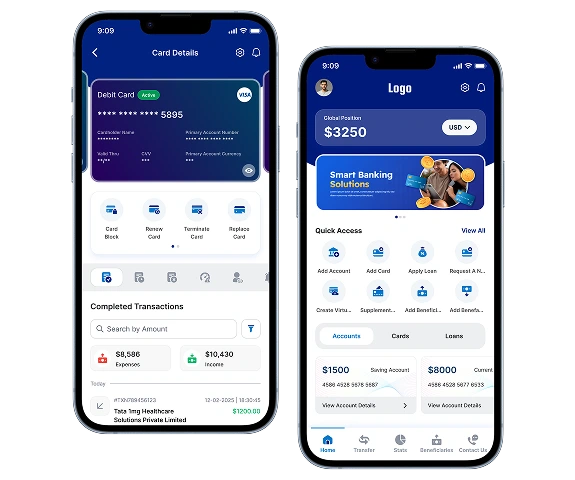

- Customizable Features: The platform allowed banks to integrate and enable a range of features, including account management, payments, card services, and more, providing a completely personalized experience for each bank’s customers.

- High Availability & Scalability: With Active/Active clustering and independent micro-services, the platform ensured continuous uptime and seamless scaling, allowing banks to grow without worrying about service interruptions.

- Cloud & On-Premise Deployment: The platform was designed to be deployed in both cloud and on-premise environments, giving banks the flexibility to choose their preferred infrastructure while ensuring maximum security and compliance.

- Open Banking Integration: Seamless integration with Open Banking APIs enabled banks to expand their service offerings and create more connected, innovative experiences for their customers.

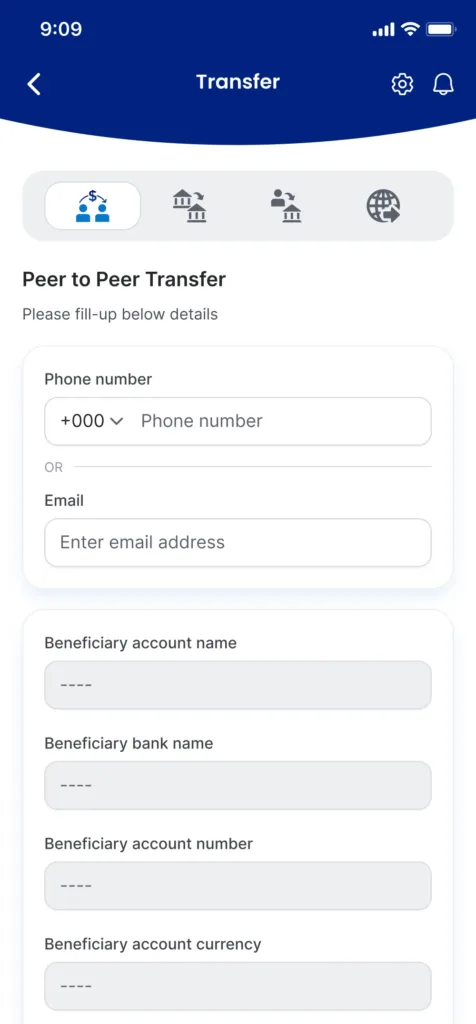

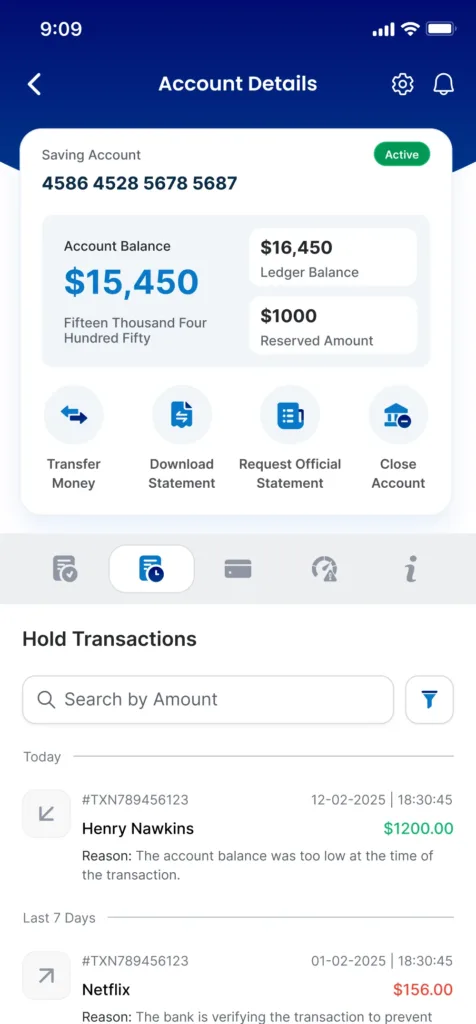

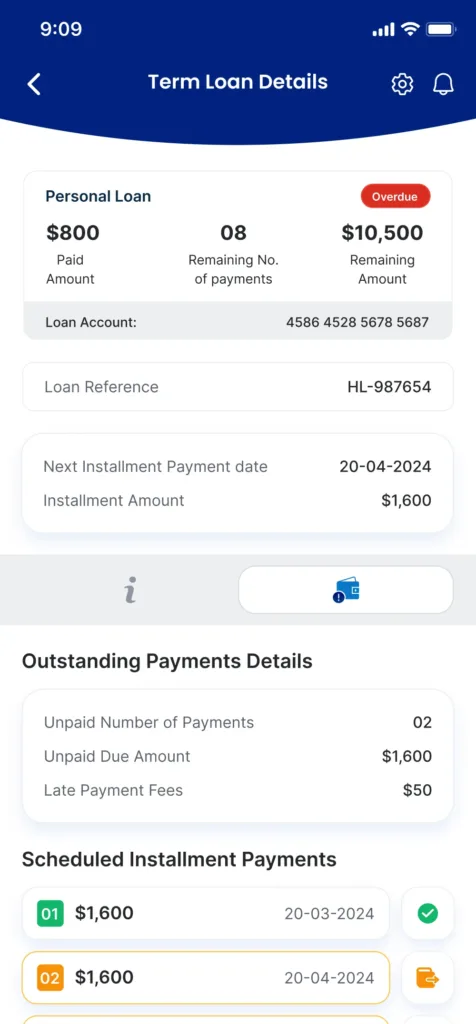

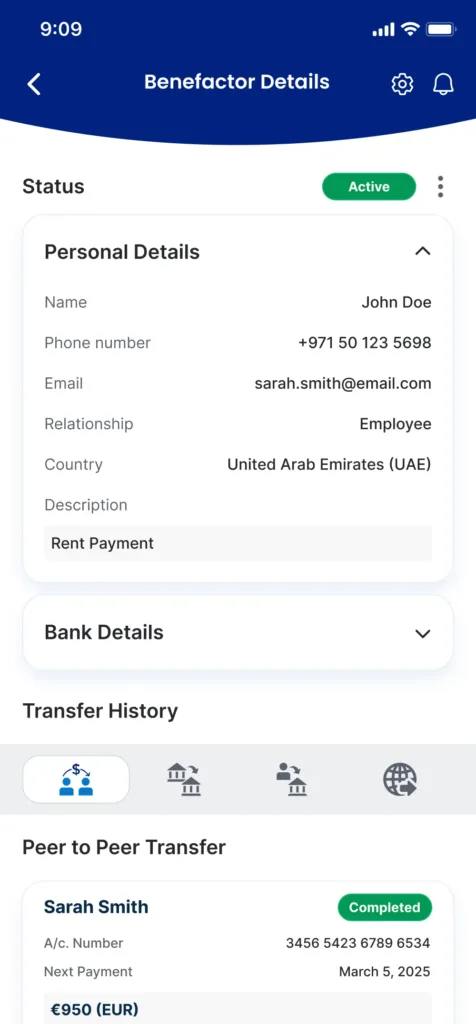

- Comprehensive key features for end-users: Account Management (view balances, transaction history, account statements) Bill Payments, Peer-to-Peer Transfers, Card Management (add, block/unblock cards, view transactions), Multi-factor Authentication (MFA) and Biometric Login (fingerprint, face recognition), Real-time Notifications & Alerts

Technology Stack

- Frontend: React Native (cross-platform development for iOS and Android)

- Backend: Java Spring Boot (scalable and secure backend framework)

- Multi-Tenant Infrastructure: Kubernetes and Docker (containerized, scalable deployment)

- Database: PostgreSQL, Oracle, MongoDB, MySQL (flexible database support)

- Security: OAuth 2.0, Multi-factor Authentication (MFA), End-to-End Encryption

- Hosting/Infrastructure: AWS (scalable and secure cloud hosting)

- Open Banking Integration: Seamless integration with Open Banking APIs

The Outcome

The mobile banking platform is a game-changer for MDSL S.a.l., empowering multiple banks to deliver custom-branded mobile banking experiences to their customers, all while ensuring security, scalability, and modularity.

Impact:

- Scalability: MDSL can now onboard multiple banks in weeks, not months.

- Security: The platform meets PCI-DSS and GDPR compliance standards.

- Customization: Banks can select the features they need, making it cost-effective and efficient.

Outcome

WebVoltz’s tailored mobile banking solution for MDSL S.a.l. has enabled multiple banks in the Lebanon and Middle East region to deliver flexible, secure, and scalable mobile banking experiences. With the ability to customize services, ensure high availability, and integrate with Open Banking platforms, MDSL has successfully provided a future-proof solution that meets the diverse needs of each bank, all while ensuring data security and regulatory compliance.

See How We Can Build Together

Inspired by what you’ve seen? We’d love to learn about your product goals and share more about how we’ve helped teams like yours launch faster, scale smarter, and deliver better results.